It was during an October 2008 campaign stop that America was introduced to instant celebrity Samuel J. Wurzelbacher - or, as he was to be more commonly known, "Joe the Plumber". As then-candidate Barack Obama was making the rounds in Holland, Ohio, he was approached by Wurzelbacher with a pointed question concerning a hypothetical small business purchase, which he identified as "the American dream":

"I’m being taxed more and more for fulfilling the American dream," he said, in reference to the candidate's previously-stated plan to allow a partial expiration of the Bush tax cuts.

"It's not that I want to punish your success," Obama replied. "I just want to make sure that everybody who is behind you, that they've got a chance at success, too… My attitude is that if the economy’s good for folks from the bottom up, it’s gonna be good for everybody. If you’ve got a plumbing business, you’re gonna be better off [...] if you’ve got a whole bunch of customers who can afford to hire you, and right now everybody’s so pinched that business is bad for everybody and I think when you spread the wealth around, it’s good for everybody."

Wurzelbacher later incorrectly described this proposal as "socialism".

While "Joe" happened to be the man in front of the cameras, he was certainly not the only person at the time to label the now-president a socialist - and many still do. For many years, talk about "redistribution of wealth" became less frequent and less passionate, but two news stories in the past week or so have brought discussions of wealth (re)distribution to the forefront once more: the recent Senate vote against a minimum wage increase, and Pope Francis' comments at the UN in support of "legitimate redistribution" (though he had touched on the idea before).

Minimum Wage

|

| The purchasing power of an hourly wage decreases over time due to inflation. |

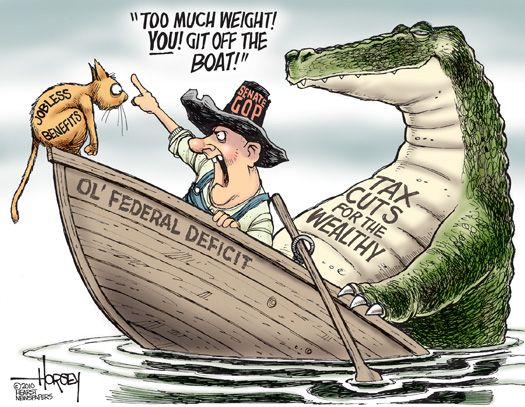

So, why is this such an issue? There are many factors, not the least of which is politics. Each side believes they have something to gain by taking their stance: Democrats will now be able to say that they acted "democratically", in that they fought to increase the minimum just as the majority of Americans favor raising it. Republicans, long favored by business owners, will be able to demonstrate that they sought to keep labor costs down in what they consider a still-fragile economy. It is not a coincidence that this push came up just a few months before the mid-term elections.

Another reason, however, is that it ties in to the larger narrative about wealth distribution. Even though the "Occupy" movement failed miserably by having no common consensus more than dissatisfaction with corporate America (and by being horribly disorganized as a collective force), the legitimate discontent that fueled them remains widespread. Corporate profits recently hit all-time highs, and worker productivity continues to climb, even though average wages have remained flat. Many companies have enacted wage reductions in the last decade and/or have decreased (or eliminated) yearly increases, leaving many, myself included, with less nominal income than ten years ago. However, the wealthiest few have, during this same time, managed to see great gains. As such, the current situation could be accurately described by replacing the phrase "open war" in Lord of the Rings: The Two Towers with "redistribution of wealth":

Théoden: "I know what it is you want of me, but I...will not risk (have) redistribution of wealth."

Aragorn: "Redistribution of wealth is upon you, whether you would risk (have) it or not."

Legitimate Redistribution?

Of course, there is no free lunch; everything has its cost. Much like the first law of thermodynamics states that energy remains constant (it can be neither created nor destroyed, only converted from one form to another), wealth and power are finite pools. Even the very existence of life on Earth requires taking life: though I know several people who do not eat meat for ethical reasons (and respect their decision), they can't survive without killing, even if only plants. Living things sustain themselves by eating other living things.

In similar fashion, the government has no money of its own, which means anything it spends, it has to either borrow from another nation, or take from its own people in the form of taxation. Just as I don't feel it is wrong to eat, I do not consider taxation to be a moral wrong, though some have equated it with theft. Supreme Court Justice Oliver Wendell Homes once remarked that "taxes are the price we pay for a civilized society", and I would agree that taxation is more akin to membership dues rather than a penalty.

Still, the amount of taxes paid, and the distribution of that revenue, continue to be greatly debated, although not using consistent criteria. For example, while many accused Obama of "socialism" based on a proposal to raise the tax rate on those making more than 250k a year back to 39 percent, the top tier during the majority of Ronald Reagan's presidency was 50%, and no one accused him of being a socialist. Any program has a cost, but merely having a cost is no reason in itself to oppose something; the question is, will it work - will it be worth the cost?

To be quite clear, economic equality is an impossibility. Though both parties are fond of including words like "fair" and "unfair" in such discussions, they don't really apply. Progressive taxation may be called unfair, but the government must pull revenue from where it lies, and certainly not everyone is born into equal resources. The more wealth becomes concentrated, the less tax policy can tax all people equally; a well that has already been drained cannot be drained again. Perhaps the questions should revolve less around indefinable "fairness", and more about sustainability.

To use an analogy, let us look at the popular board game, Monopoly. In that game, all players begin the game with equal resources. There is no progressive taxation, the rules apply equally to all players, and everyone gets the same $200 for completing the square (how many turns it will take to do so is beyond the player's control). Even with such "fairness", the game can't last forever, even though it may feel like it - someone will inevitably walk away with all the money and property that used to belong to everyone (and all "fair and square"). Of course, being a board game, losing does not mean you can no longer keep your (real) home or afford to send your kids to college.

The American Dream?

The "American dream", as I understand it, is perhaps best illustrated in the works of American author Horatio Alger, Jr. His stories were typically variations on the "rags to riches" theme, about the penniless lad who started working for some rich and powerful corporate mogul, and who eventually caught his attention through his character and work ethic. Certainly, capitalism can't succeed without some measure of "legitimate" inequality, whereby those that work harder or longer should be entitled to greater monetary reward. However, it appears that American society has moved away from rewarding hard work and toward rewarding wealth itself.

The "American dream", as I understand it, is perhaps best illustrated in the works of American author Horatio Alger, Jr. His stories were typically variations on the "rags to riches" theme, about the penniless lad who started working for some rich and powerful corporate mogul, and who eventually caught his attention through his character and work ethic. Certainly, capitalism can't succeed without some measure of "legitimate" inequality, whereby those that work harder or longer should be entitled to greater monetary reward. However, it appears that American society has moved away from rewarding hard work and toward rewarding wealth itself.The American dream is not merely about allowing an unlimited monetary potential, but about providing opportunity to anyone willing to work. Two years ago, on a trip to Washington, DC, I noticed the following quote at the Roosevelt Memorial, "The test of our progress is not whether we add more to the abundance of those who have much; it is whether we provide enough for those who have too little." A similar comment was made by Barack Obama in his 2009 Inaugural Address: "The nation cannot prosper long when it favors only the prosperous. The success of our economy has always depended not just on the size of our gross domestic product, but on the reach of our prosperity; on the ability to extend opportunity to every willing heart -- not out of charity, but because it is the surest route to our common good."

Like a fountain requires water to fall back to the base, a free market simply can't long exist without redistribution. A progressive tax system is one way the government can help replenish the base, but certainly not the only way, and I admit that some proposals concerning redistribution (downward) don't involve the government at all. The ideal, as explained to me by conservative Christians, is a system by which individuals voluntarily provide for the needs of those without, perhaps facilitated by the Church. I fully agree that such a system would be ideal, but it is hardly a realistic option. The average church spends the vast majority of its budget on itself: staff wages, maintenance of facilities, and programs aimed at religious instruction. Less than three percent of the monies received by a church (though they are considered charitable contributions) will go to help anyone outside of it. I do not fault the typical church's leadership for this as much as those of us that provide the income; I'd like to think that the Church would provide more humanitarian aid than it does (relative to what it keeps for itself) if they had more money to spend - obviously there is a de facto minimum cost of operation. I would like to live in a world where people were happy to give to others (I'd also like to live in a world without illiteracy or war), but I would rather the poor be aided by an inefficient government program that obtains its money from less-than-voluntary means, than for virtually no aid to be provided at all.

One point that has been made by those in opposition to raising either the minimum wage or tax rates is the likelihood that any additional costs encountered by business will merely be passed on to consumers (rather than reductions being made elsewhere, such as executive compensation). While this is a fair assumption, the same could be said for any cost. Should we then all demand that executive compensation be capped at a maximum, because the money paid to the CEO ultimately comes from our wallets as consumers? Should we ban business seminars in Vegas? It just seems odd to demand fiscal conservatism on the low end, but not the top - whether we are talking about a corporate or national budget. Such selectivity allows for continued redistribution of wealth - but only in one direction.

No comments:

Post a Comment